Loudoun County’s commercial real estate investment history is built on a solid bedrock of key lines of business, a powerful track record, and positive local government support. There is a fourth bedrock element to successful CRE investment in Loudoun County, which we will come to later.

Benefits of Investing in Loudoun County

The benefits of successful investment can be achieved both short-term and long-term. In our September article, we discussed The Top 10 Reasons to Invest in Northern Virginia including Loudoun County.

10 Reasons and 5 Benefits

In September’s article, as well as discussing the ten reasons, we also explored the 5 primary benefits. You can read the detail in the article, but in a nutshell, investors benefit from investing in Loudoun County and the rest of Northern Virginia because of:

- Positive cash flow for the passive investor.

- Intrinsic value of owning a tangible asset.

- Tax advantages delivered through deductible costs and by deferring capital gains tax at sale.

- A hedge against inflation through increased operating profits when the investment is in a location with Loudoun County’s record. When there is an almost continuous 13-year population growth of well-qualified and well-paid residents, business turnover and profits ride in tandem.

- Leverage reduction and increased equity are a hallmark of Northern Virginia and Loudoun County’s CRE market.

Loudoun County CRE Bedrock

Secondary and Tertiary lines of business benefit from Loudoun County’s key business sectors.

- Loudoun’s data centers are driven by the continually increasing demand for all aspects of today’s (and tomorrow’s) technological demands.

- Information and Comms Technology is centered in Loudoun County.

- Loudoun County’s location provides constant access to government agencies and federal contracts.

- The aerospace sector, with easy access to NASA and the Department of Defense, delivers even more CRE opportunities for both passive investors and owner-operators in Loudoun County.

- Agriculture and related businesses, particularly retail, serve Loudoun’s growing population.

Loudoun County Opportunity Zones and Business Incentive Programs

Positive local government support crystallizes into these two elements. While Loudoun County, as a whole, is known for its positive economy, there are just two zones (out of 8,700 in the US) identified in the 2017 Tax Cuts and Jobs Act considered Opportunity Zones. Two benefits of investing in these zones are that 15% of original cap gains are eliminated and appreciation is tax-free from cap gains when the investment is held for 10 years.

Loudoun County also offers additional financial incentives. For the right businesses looking to start up or expand in Loudoun County. They include:

- The New Jobs Program

- The Small Business Jobs Program

- Sales and Use Tax Exemptions

- The Commonwealth’s Opportunity Fund

- Programs offering direct, loan-guarantee, and low-interest financing.

The benefits and opportunities for CRE investors in Loudoun County are there and are being taken advantage of by many new and existing businesses, as well as the investors who own the properties themselves.

Now let us look at Loudoun County’s commercial real estate market through current statistics. In this way, you, as a potential investor, will see both opportunities and factual basis to move forward.

Loudoun County Commercial Real Estate Market Statistics for October 2023

We will list the CRE statistics for Loudoun County overall, and then break them down for each of the four sectors: Office, Industrial, Retail, and Flex.

Loudoun County CRE Market Statistics

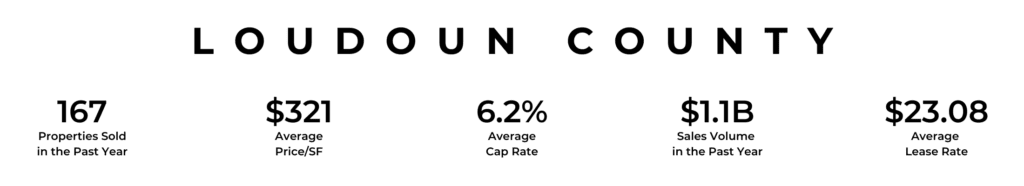

Overall Statistics for Loudoun County

- Existing Buildings: 2,545

- Asking Price/SF YTD: $321

- Sale to Asking Price Diff: -6.9%

- Market Rent/SF: $23.08

- Market Cap Rate: 6.2%

Loudoun County Sales in the Past Year

- Overall Sales Volume: $1.1B

- Total Properties Sold: 167

- Average Months to Sell: 8.7

- Properties Listed for Sale: 97

- Total for Sale SF: 784K

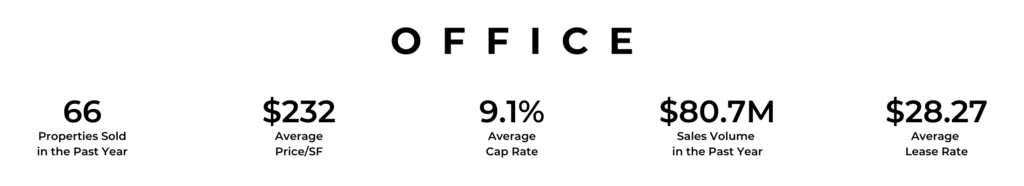

Loudoun County Office Sector (Including Medical, Law firms, Administrative, etc.)

- Existing Buildings: 608

- Asking Price/SF YTD: $232

- Sale to Asking Price Diff: -6.1%

- Market Rent/SF: $28.27

- Market Cap Rate: 9.1%

Loudoun County Office Sector Sales in the Past Year

- Overall Sales Volume: $80.7M

- Total Properties Sold: 66

- Average Months to Sell: 10.2

- Properties Listed for Sale: 65

- Total for Sale SF: 430K

Loudoun County Industrial Sector (Warehouse, Distribution, etc.)

- Existing Buildings: 409

- Asking Price/SF YTD: No Data Available

- Sale to Asking Price Diff: No Data Available

- Market Rent/SF: $16.52

- Market Cap Rate: 6.0%

Loudoun County Industrial Sector Sales in the Past Year

- Overall Sales Volume: $36.6M

- Total Properties Sold: 15

- Average Months to Sell: 8.7

- Properties Listed for Sale: 4

- Total for Sale SF: 77.9K

Loudoun County Retail Sector (Early Education Centers, Services, Coffee Bars, etc.)

- Existing Buildings: 1,102

- Asking Price/SF YTD: $529

- Sale to Asking Price Diff: -7.1%

- Market Rent/SF: $34.53

- Market Cap Rate: 6.4%

Loudoun County Retail Sector Sales in the Past Year

- Overall Sales Volume: $149M

- Total Properties Sold: 39

- Average Months to Sell: 7.2

- Properties Listed for Sale: 18

- Total for Sale SF: 182K

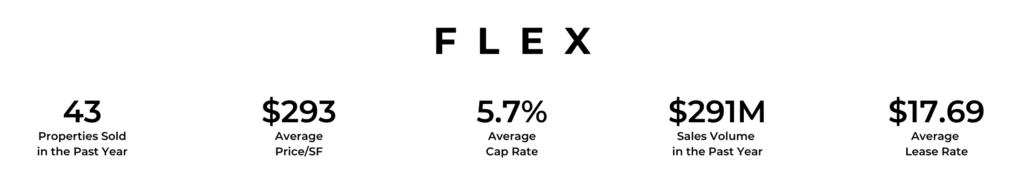

Loudoun County Flex Sector (Office and Warehouse Mix, Retail and Warehouse Mix, etc.)

- Existing Buildings: 282

- Asking Price/SF YTD: $293

- Sale to Asking Price Diff: -7.8%

- Market Rent/SF: $17.69

- Market Cap Rate: 5.7%

Loudoun County Flex Sector Sales in the Past Year

- Overall Sales Volume: $291M

- Total Properties Sold: 43

- Average Months to Sell: 5.8

- Properties Listed for Sale: 10

- Total for Sale SF: 94.6K

The 4th Bedrock Element to Successful CRE Investment in Loudoun County

The fourth element divides into two parts:

- Knowing enough to understand the CRE market, not just snapshot knowledge, but consistently updated and detailed knowledge. Armed with accurate and current detail, you can make the right decisions about both buying and selling. Knowledge is powerful, whether you are a passive investor or an owner-operator.

- Building a relationship with, and, when the time is right, working directly with the most successful commercial real estate brokerage in the area.

Let’s explore those two, just to reinforce the points.

Understanding the CRE Market

When you keep yourself informed about the Northern Virginia CRE market, you can make the right decisions. The easiest way to stay on top of what is happening in the market is to get regular, detailed, and accurate reports such as this one and also the kind of in-depth reports Serafin Real Estate publishes. As well as county-specific and market sector updates, you will want to receive our annual market reviews.

Work with Serafin Real Estate

The second part to successful investing is to build a relationship with, and take advice from, Northern Virginia’s leading CRE Broker. As well as being one of Virginia’s Top 10 Brokers, our company was awarded The Best of Loudoun commercial real estate company in 2022 and 2023. And we have the top sold volume for the last three consecutive years.

Get Our Market Updates

If you are not already on our mailing list, please just click here to start receiving our reports, and if you have questions, this link will enable us to get right back to you.

Sources: Data obtained from costar.com and proprietary internal information of Serafin Real Estate Inc.