Northern Virginia Commercial Real Estate Investment Delivers Positive Results

“Don’t wait to buy real estate; buy real estate and wait.” Is a classic quote we all know. But, like all classic quotes, its relevance depends on specific factors and proven principles. In this article we will discuss the value of investing in commercial real estate. Our readers will be able to focus on the 2022 and 2023 Northern Virginia (NoVa) CRE market as well as comparing current stats with the past 10 years

Investing in Commercial Real Estate

Commercial Real Estate (CRE) falls into 10 main categories: vacant land, office, industrial, flex, multi-family, healthcare, specialty, general retail, sports and entertainment, and hospitality. Each has its own market segment.

Owners may be passive investors or owner-operators. They may be sole investors, be part of an investment syndicate or have financial partners leaving the business operator to focus on their areas of expertise serving their own market niche and generating operating profit.

The marginal value of each property type, making them especially valuable, depends on local market strengths and weaknesses, location, property condition, suitability-for-purpose, etc. Choosing the right property for simple investment or to serve a market niche is based on local knowledge, experience, and, when working with a professional, an excellent track record.

CRE consistently shows its resilience even though sub-sectors, such as hospitality and retail, were particularly subject to the impact of COVID and current inflationary pressures.

The Primary Benefits of investing in CRE

The primary benefits of owning CRE apply to both passive investors and owner-operators. Some benefits are more closely aligned to one or the other at different times, but they all remain relevant. They include:

- Positive Cashflow. A passive investor receives rental income. Leases specify how the rents will increase each year as well as determining whether the owner or the lessee will be directly responsible for property taxes, building insurance, maintenance costs, utilities, etc. Rents are determined according to both who pays for such operating costs and the Ricardian Law of economic rent. An owner-operator’s costs exclude rent, but include interest on the mortgage. In both circumstances, by choosing the right property in the right market sector, cash flow should be positive. History shows that returns on CRE ownership outperform returns on the S&P 500.

- Intrinsic Value. Tangible assets maintain value, even in economic downturns, unlike stocks which can plummet in value overnight. Rents may be late, a particular market segment may be hit hard, tanking the business income of the operator, but the asset itself is unlikely to become worthless, so, even if the owner suffers a major business downturn, the property can be sold. But, covering basic costs and waiting (to repeat the headline quote) is often the best policy.

- Tax Advantages. Depreciation and the cost of loans are tax deductible. Capital gains taxes can be reduced, deferred (1031 Exchange,) or avoided, unlike taxes on most other investments.

- Hedge Against Inflation. Economies grow, rents increase, and turnover and profitability increase because secondary and tertiary lines of business improve. This is clearly seen in Northern Virginia’s economy. And therefore generates greater turnover for the property’s occupant. The increased operating profit can offset inflationary pressures.

- Leverage Rental income. (Or business operating profit) pays off current debt, reduces leverage, and increases equity. If an owner, for example, has an 80% mortgage debt, the monthly income and asset appreciation only needs to equal 20% for the equity to double in value.

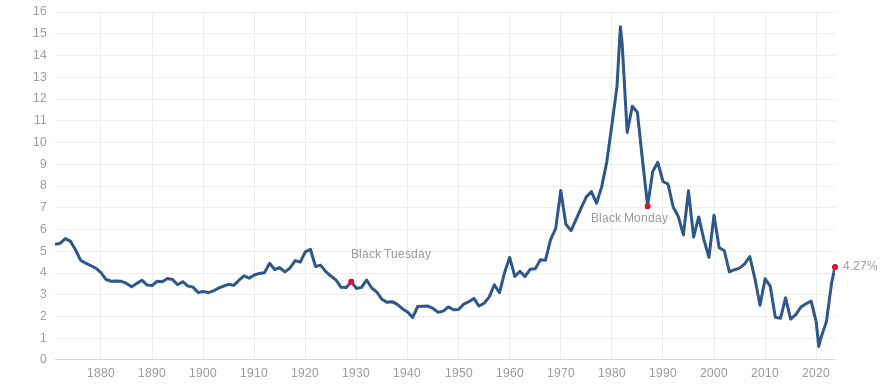

If we stay with interest rates, a recent study looking back almost 100 years shows that the median treasury rate is 4.49%. Banks use this metric to price commercial loans, so, even if interest rates rise over the short term, over the longer term there is an expected level of stability. As of this writing, the treasury rate is only 4.27%. For new borrowers this may seem high, but it is in line with the long-term rate levels.

Source: https://www.multpl.com/10-year-treasury-rate

- Proptech Reduces Costs. Modern technology enables investors and owner operators to reduce inefficiencies and lower their costs by employing smart buildings tools, digital marketing programs, and digital rental payments, etc. Lowering costs increases profitability.

CRE General Summary

Looking generally at commercial real estate, there are a number of advantages for both passive investors and owner operators. Choosing the right property in the right location for the business purpose are two critical factors to be assured of in-built success. Capital appreciation; long-term business growth; regular and increasing passive income all play their part.

Now let’s drill down into the recent Northern Virginia CRE market. The following includes the counties of Fairfax, Fairfax City, Loudoun, Alexandria, Arlington, Falls Church, Prince William, Manassas, and Manassas Park.

Northern Virginia CRE Market 2013 – 2023

We will compare the first eight months of 2022 to 2023, and also, where appropriate, include the past 10 years.

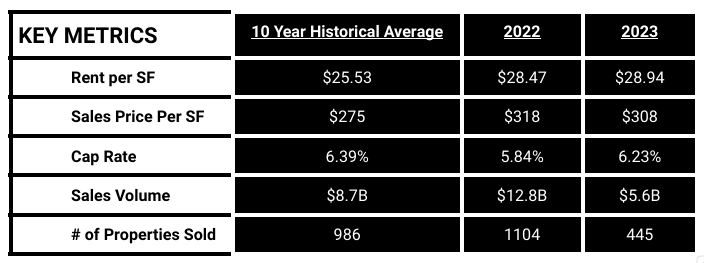

NoVa 2022 – 2023

NoVa Sales Volume and $/SF 2013 – 2023

The quarterly stats for 2022 and 2023 give us a “right now” and “close-in” view of NoVa’s CRE market. If we take a step back and look at the past 10 years we get a broader perspective and we see numbers which reflect our opening quotation.

We see that total sales over the past 10 years were just over $92.9 Billion.

NoVa Market SP/SF and Cap Rates 2013 – 2023

Now let us list annual Market Sales Price per Square Foot (per end of year graph position) and the annual average Cap Rate for each year.

Year Market SP/SF Cap Rate

2023 $270.66 (YTD) 6.135% (YTD)

2022 $307.00 5.768%

2021 $315.16 6.109%

2020 $295.70 6.418%

2019 $275.70 6.434%

2018 $268.50 6.132%

2017 $264.31 6.824%

2016 $264.31 6.310%

2015 $263.60 6.477%

2014 $256.00 6.758%

2013 $242.86 6.942%

NoVa’s 10 Year SP/SF and Cap Rate Summary

- 2023’s YTD Market SP/SF is the fourth highest in the past decade.

- 2023’s Cap Rate is the third lowest in the past decade.

- Cap Rates in the past 10 years have only fluctuated by 1.174% from its low of 5.768% in 2022 to its high of 6.942% in 2013.

- The average for all 10 years is a 6.39% cap rate.

These numbers tell us that Northern Virginia’s CRE is quite a stable market when we look at a 5 to 10 year holding period, especially when we consider the devastation the COVID brought to the national economy.

Ten Primary Reasons for Investing in Northern Virginia’s CRE Market

The strength of Northern Virginia’s commercial real estate market has both breadth and depth. Many markets offer some of NoVa’s strengths, but few, if any, can offer all of them to would-be investors and owner-operators. This makes the market uniquely attractive. The strengths and, therefore, the advantages will continue. The result will be healthy, long-term results. Let’s check them off.

- Proximity to Washington DC. The national capital draws broad government and private investment, a highly trained workforce, high salaries, professionals and family members with high expectations for their own employment, their own and their children’s education, healthcare, relaxation, and purchasing opportunities.

Northern Virginia, therefore, offers close proximity to the DC area, while avoiding=ng some of the disadvantages like congestion and overall higher costs. Individuals and families choose this area because it delivers the best of both worlds. That, on its own, delivers a powerful knock-on effect for business investment. - Government Contracts. Because of the lower costs and Northern Virginia’s state and local government initiatives, many companies that serve the DC area as government contractors or service providers are based here. Long term contractors have long term real estate needs, so they make excellent lessees. Their employees live in the area, so their needs: education, childcare, hospitality, relaxation, etc. must also be served.

- Tech Hub. Dulles Technology Corridor, aka Silicon Valley of the East, draws new and expanding tech companies into the area. Many are start-ups and others are new branch offices of existing and successful companies, both national and international. Tipalti’s International Digital Economy Report published earlier this year ranks Virginia as #1 in the USA for its digital economic outlook.

- Well Established Transportation. Airports, major highways, and the metro serve local, national, and international travel and transport needs. There are three major airports serving the area, several metro rail lines, plus I-95, I-495, and I-66 and two VRE commuter rail lines serving the area.

- Diverse economy. National and regional government demands, major and local business needs, plus residents’ needs and wants have all resulted in NoVa having a strong and diverse economy. Major corporations of all sorts, healthcare, education, and many other professional services are integrated into the area and have ensured the economy that will continue to grow. The massive and diverse needs of so many lines of business mean that owning, constructing, redeveloping, and maintaining commercial properties will continue and will proliferate. To provide some context, Northern virginia has 38% of all jobs in the Commonwealth. Non-agricultural employment in 2023 is expected to grow by 1.1% over 2022’s 2.8% growth. Financial, professional, leisure, hospitality, and business services will drive the growth. Wages and salaries are expected to grow by 5.3% this year (on top of last year’s 4.5%.) Dividends, interest, and rental income grew by 10.5% in 2022, and is forecast to increase by another 4.5% this year.

- Competitive Tax Environment. The Commonwealth of Virginia is well known for its positive tax climate. Incentives of different sorts are available to new and expanding businesses based in NoVa.

- Educated Workforce. Nova has a well-educated and well-paid workforce. Top tier universities and institutions generate graduates who expect higher incomes, high quality social and economic infrastructure for themselves and their families. Childcare, and early learning establishments see a continuing demand that must be satisfied.

- Cultural Diversity. This cosmopolitan region draws employers and employees from all over the globe. This alone encourages start-up businesses to base themselves here to satisfy the diverse demands.

- Quality of Life. NoVa is a wonderful place to live. The green spaces, cultural attractions, social, educational, and sporting events encourage people to want to live here.

- Future Growth. Northern Virginia’s growth trajectory has every reason to continue. More businesses can be open and expand. Government programs to encourage and make it easier for tem to do so can be expected to continue and refine to meet specific demands. Infrastructure will expand, social and cultural ecosystems will do the same. The need for commercial real estate will continue and increase. Property values can be expected to appreciate, and net operating incomes can be expected to do the same.

Serafin Real Estate

Northern Virginia is the Commonwealth’s economic engine, and is ranked the 46th largest economy in the world. The SRE team are experts in Northern Virginia’s commercial real estate market. If you would like to learn more about us, then please check us out. If you would like to learn more about Northern Virginia’s CRE market trends and news, we publish monthly updates.

In addition, we welcome your questions. Please feel free to contact us by clicking this link.

Sources: www.costar.com; Serafin Real Estate’s proprietary internal company information and research.