Loudoun, Fairfax, and Prince William Counties: CRE Q3 Report

Northern Virginia’s economy is strong. Our recent blog post did a deep dive into 10 commercial real estate subsectors. Today we will focus on Loudoun, Fairfax, and Prince William Counties as locations for successful investment. As well as reviewing listing and sales volume, market prices, and cap rates, we will look at what these three counties offer businesses and property investors.

Loudoun County

The County’s Department of Economic Development has just received the Gold Award for Economic Development Organization of the Year by the International Economic Development Council.

Primary factors which help to drive Loudoun County’s economy include, and have resulted in, it leading the entire USA in attracting the most investment for a county of its size. This is partly because 60% of Loudoun’s workforce has a bachelor’s degree or higher. The county boasts a high median income, and residents enjoy a relatively low cost of living compared to household income level.

Key industries in Loudoun County cover a broad spectrum which also encourages entrepreneurial and corporate growth and real estate investment. Major industries include data centers; information and comms technology; aerospace, defense, aviation and transportation; health care and biomedical research; agriculture, horticulture, and viticulture. Add in DC’s proximity, and the opportunities for Federal Government contractors are huge. Loudoun also boasts more than a dozen urban spaces rich with amenities as a base for mixed-use business investment and, of course, PreK-12 education establishments.

Loudoun County 2021 CRE Statistics

If we look at each quarter, we see that total listings, sales volume, and price paid per square foot were as follows:

- Q1: saw 136 properties listed for sale, with a closed sales volume of $442,150,472. The average $/SF was $242.

- Q2 also saw 136 properties listed, with a closed sales volume of $703,636,565 delivering a 59% increase in closed investment. $/SF also increased by almost 3% to $249.

- Q3 saw 113 properties listed, and closed sales of $382,146,383, with a 4.4% increase in $/SF to $260.

After the first two quarters’ sales figures, it is not surprising that Q3’s closed volume was lower. The focus point is that the price paid per SF was at its highest for the year to date.

Comparing this year with last, we see that in 2020Q3 163 properties were listed (113 in 2021Q3); sales totaled $378,738,186 in 2020Q3, fractionally below 2021Q3, and the average $/SF was $238 compared to $260 this year. This year’s Q3’s $/SF averaged 9.24% higher than last year’s Q3.

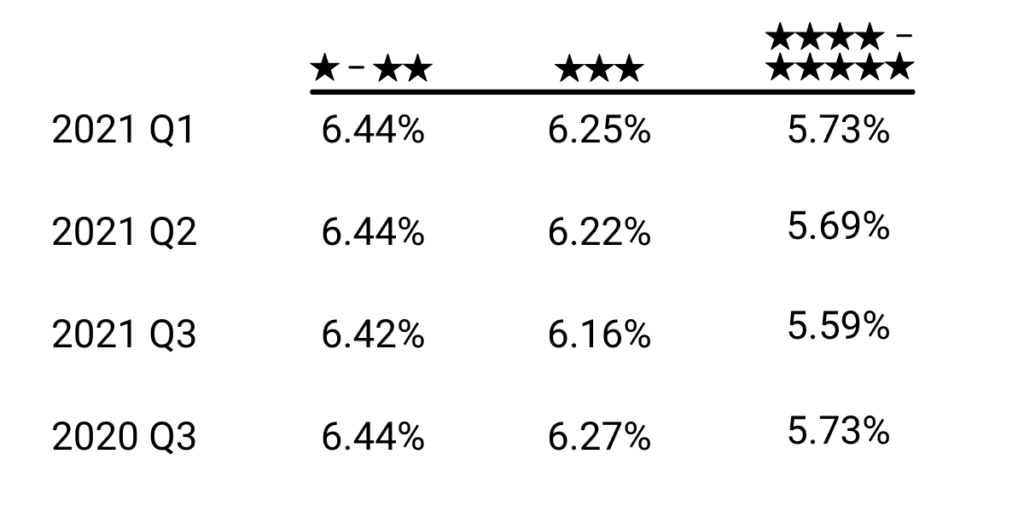

If we now review cap rates by Star Ratings, we see:

Fairfax County

Fairfax County also has a very strong economy. Its location has attracted highly educated and skilled professionals for a long time. Both businesses and the people they employ enjoy high-yield rewards, resulting in Fairfax developing a huge suburban office market. 430 international companies, including 11 Fortune 500 companies, are headquartered here. It is, perhaps, worth noting that the 6% corporate tax rate has not changed since 1972, the average annual salary is well above the US average, at $57,492 and the median household income is over $128K.

Major industries include defense and aerospace, financial services; IT, health and life sciences, and a host of emerging technology-based businesses. Fairfax County has more foreign-owned or foreign-affiliated businesses than anywhere else in the Greater Washington area.

Fairfax City

The City of Fairfax 2021 Fact Book makes enthralling reading, and provides everything a C-suite executive or property investor would want to know about the city’s population, neighborhoods, transportation, housing, community services, and economic drivers.

By way of a simple summary, the city population is 24,000, median household income is $117,000, 60% of residents have a bachelor’s degree, and 30% have a graduate or professional degree. And there are just under 1700 employers (all numbers rounded for easier reading.)

Fairfax County 2021 CRE Statistics

We will now provide the stats for Fairfax County as we did for Loudoun, listing Qs 1-3 for this year, then for Q3 2020.

- Q1saw 260 commercial properties listed for sale with a closed sales volume of $407,252,824 at an average of $276/SF.

- Q2’s listings dropped to 247 properties, but closed sales increased to $825,415,488 (a 103% increase over Q1) with an average price per SF of $281, an increase of 1.81%.

- Q3 saw 240 active listings and sales of $817,886,316, with a $/SF of $288, representing a 2.4% increase over Q2 and a 4.35% increase over Q1.

Each quarter’s figures demonstrate a robust CRE market. Qs 2 and 3 reflect the post-pandemic economic recovery and a continual rise in average $/Sf paid by businesses and investors.

2020Q3’s active listings were higher than 2021 Q3, standing at 272. Closed sales volume was $535,488,741, just over half of this year’s Q3 sales. The average $/SF was $273, or 5.49% less than Q3 2021′ $/SF.

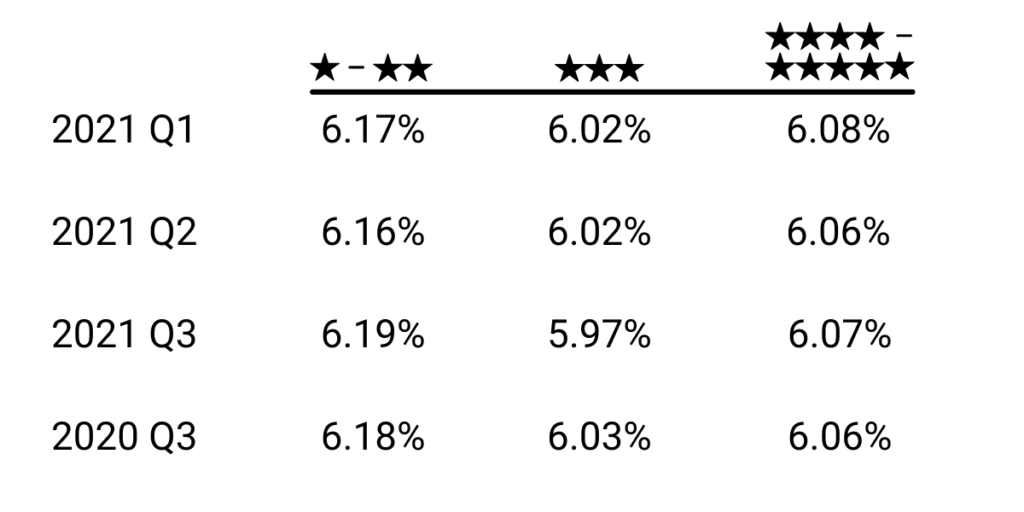

Cap rates by Star Rating give us:

Prince William County

Prince William County is the second largest county in Virginia. Its economic development programs are in place to “promote, retain, and accelerate profitable growth.” Some specific industry sectors benefit from expedited services to encourage new investment in those sectors. These target areas include life sciences; IT and comms technology; supply chain logistics; Federal Government contracting and facilities suppliers; and other entrepreneurial initiatives. Prince William County programs also exist to help identify growth markets and to ensure that companies which base their corporate or branch operations here have the space to build new and to extend existing premises.

All this has made it one of the fastest-growing counties in the Commonwealth. Last year, 15 locally-based companies made the Washington Business Journal Book of Lists.

To reinforce the county’s attraction to employers, 42% of residents have a bachelor’s degree, and those with advanced degrees equal two-and-a-half-times the national average. Almost one-third of workers are involved in STEM-related employment. For a longer-term perspective for future recruitment, county high schools rank in the top 9% nationally and six well-respected colleges and universities are based here.

Prince William County 2021 CRE Statistics

- Q1 of this year had 90 active listings and closed sales totaled $230,602,360. Price/SF averaged $239.

- Q2’s active listings stood at 89, and closed sales at $585,329,908 with an average $/SF of $238.

- Q3’s active listings were 95 and closed sales stood at $122,686,841 with an average $/SF of $249.

After Q2’s surge, it is not surprising that Q3’s closed sales were as reported. The average price paid per SF was stable for the first half of the year, but Q3 saw a 4.6% rise. 2020Q3’s active listing count was 103, closed sales were $262,334,739, and $/SF averaged $230. Q3’s average $/SF was, therefore, almost 8.3% higher than a year ago.

Cap Rates By Star Ratings

Using the same analysis as with Loudoun and Fairfax, we see:

Summary Comment

We see that Loudoun, Fairfax, and Prince William Counties’ economies are strong. Local governments not only intend to encourage commercial investment, and attract and keep well-qualified residents, but recent national and international awards show how well they are succeeding. Like-follows-like is a well-established axiom, and is reflected in investment opportunities and the prices businesses and investors are prepared to pay to reap the rewards offered by these counties’ locations.

As one of the leading commercial brokerages, Serafin Real Estate is the first choice for many investors and owner-users in Northern Virginia whose goal is to maximize returns. Effective decision-making begins with seeking expert advice which will support your corporate strategy and is integrated with on-the-ground understanding of specific local factors, drivers, and obstacles.

If you would like to discuss real estate acquisition or disposition in Loudoun, Fairfax, or Prince William County, please either call Serafin on (703) 261 4809, or leave your contact details and a brief message by clicking this link.

Other sources not directly referenced in the text:

https://biz.loudoun.gov/key-business-sectors/

https://biz.loudoun.gov/2018/01/30/10-ways-loudoun-county-virginia-no-1/

https://www.fairfaxcountyeda.org/small-business/inclusive-business-climate/

https://www.fairfaxcountyeda.org/doing-business/economic-advantage/

https://www.pwcded.org/biz-environment