Finding Certainty in an Uncertain Market: The Dulles Region’s Commercial Real Estate Outlook

The Dulles Region’s Strength Lies in Data, Not Speculation

At the Dulles Regional Chamber of Commerce IGNITE for Growth event, “Finding Certainty in an Uncertain Market,” Serafin Real Estate’s Principal Broker, Joe Serafin, shared proprietary insights into the commercial real estate market across the Dulles Region. The presentation underscored a clear truth: certainty comes from fundamentals, not forecasts.

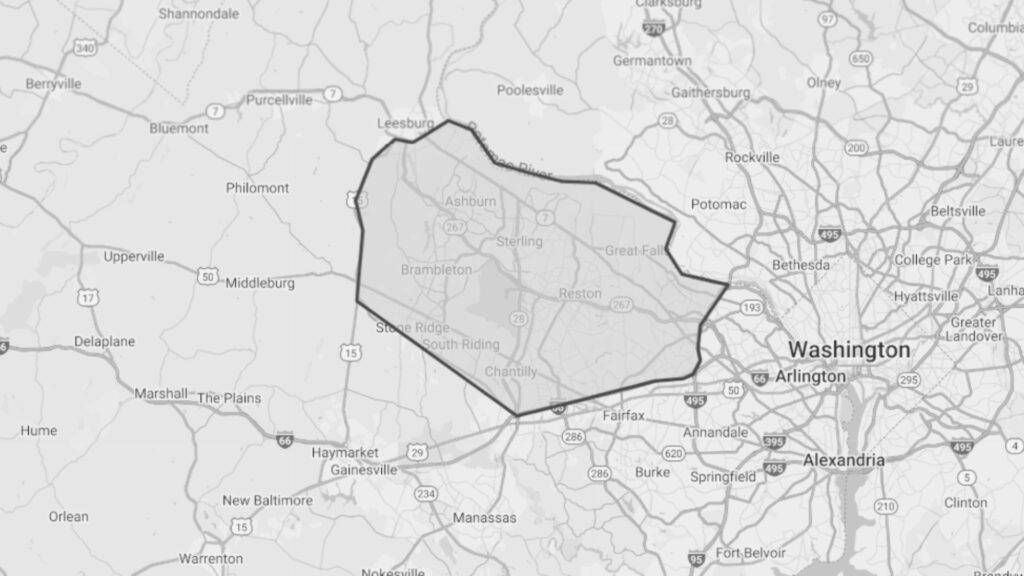

The Dulles Region continues to demonstrate resilience, balance, and long-term stability, fueled by strong demographics, infrastructure investment, and an education-driven economy. From Dulles International Airport through Leesburg, Ashburn, Sterling, Herndon, and Reston, the market remains Northern Virginia’s most dynamic commercial corridor.

A Comprehensive Market Overview

According to Serafin Real Estate’s proprietary regional data, the Dulles market holds:

- 208 million square feet of total commercial inventory

- A 10.2% vacancy rate, trending down 0.7 points year-over-year

- $3.3 billion in total sales volume, up $1.1 billion from the prior year

- An average sale price of $293 per square foot, up 3.9%

- 3.4 million square feet of positive net absorption

These figures highlight a tightening market, signaling that businesses are renewing leases and expanding, rather than contracting. With an average lease timeline of 9.2 months, the region’s commercial sector reflects both patience and confidence.

Office Market: Recalibration and Reinvention

The office sector is stabilizing after several years of adjustment.

- Sales Volume: $1.3 billion

- Vacancy Rate: 19.4% (down slightly year-over-year)

- Average Rent: $34.39 per square foot

Although demand has moderated, we’re now seeing adaptive reuse and repositioning drive the next phase of opportunity. Offices near mixed-use and transit-oriented developments remain the most sought-after.

Retail: The Steady Performer

Retail continues to outperform expectations with tight vacancies and rent growth.

- Vacancy Rate: 4.4%

- Average Rent: $39.63 per square foot

- Average Sale Price: $373 per square foot

Neighborhood and grocery-anchored centers remain strong performers. Even as national retailers recalibrate, local operators and experiential concepts are expanding steadily across Loudoun and Fairfax.

Industrial: The Regional Powerhouse

Industrial properties remain the backbone of the Dulles economy.

- Vacancy Rate: 2.1%

- Average Rent: $19.59 per square foot

- Average Sale Price: $313 per square foot

While new supply has slowed, tenant demand continues to climb. The Dulles corridor’s proximity to IAD, data centers, and major transportation routes ensures ongoing interest from logistics and light manufacturing users.

Flex: The Hybrid Solution

Flex space continues to thrive as businesses seek adaptable environments combining warehouse, office, and light production.

- Vacancy Rate: 2.1%

- Average Sale Price: $333 per square foot

Rents have risen nearly 6% year-over-year, and pricing remains at record highs. Companies are leveraging flex buildings to optimize space and maintain operational efficiency.

Multifamily: Moderating After Peak Growth

The multifamily market is moving from rapid expansion to stable performance.

- Vacancy Rate: 7.4%

- Average Rent: $2,381 per month

- Average Sale Price: $370K per unit

Despite cooling investor activity, core fundamentals remain strong. The region’s population growth and constrained housing pipeline continue to support occupancy and rent stability.

Hospitality: Recovery with Caution

Hospitality is rebounding with 72% occupancy and an average daily rate of $153. However, investment remains cautious due to limited new supply and capital constraints. Even so, the Dulles market’s business travel and event demand provide steady occupancy momentum.

Capital Markets: Confidence Amid Headwinds

Total sales volume reached $3.3 billion, marking a $1.1 billion increase from last year. Despite elevated interest rates, cap rates have held firm at 7.0%, a sign of investor confidence.

Notably, 41% of all sales were driven by private capital, showing that individual and regional investors continue to believe in the area’s long-term fundamentals.

Resilience and the Path Forward

Every major property type in the Dulles Region shows measured strength and strategic opportunity. Industrial and flex assets lead in demand, retail remains solid, office continues to evolve, and multifamily stays resilient.

Serafin Real Estate’s conclusion is clear:

The Dulles Region is not a speculative market — it’s a data-driven opportunity built on fundamentals, infrastructure, and smart capital.As we look ahead, balance, stability, and adaptability will define success. With population growth, expanding transportation networks, and institutional investment, the region remains Northern Virginia’s most reliable commercial real estate market.

About Serafin Real Estate

Serafin Real Estate is Northern Virginia’s leading brokerage specializing in early education centers, churches, and owner-user commercial buildings. Based in Loudoun County, the firm consistently ranks among Virginia’s top commercial brokers. Joe Serafin has been recognized statewide for his market expertise, use of advanced technology, and record-setting transactions across Loudoun, Fairfax, and Prince William Counties. William Counties.

Serafin Real Estate

40834 Graydon Manor Lane, Leesburg, VA 20175

Phone: 703.261.4809 Email: info@serafinre.com Website: https://serafinre.com

Joe Serafin

CEO | Founder | Principal Broker

Phone: 703.994.7510 Email: jserafin@serafinre.com