Northern Virginia CRE Market Trends (Q1 2023 – Q2 2025): What the Data Tells Us

The Northern Virginia commercial real estate market has remained surprisingly active despite rising interest rates, tighter lending conditions, and shifting economic dynamics. From Loudoun to Fairfax to Prince William County, buyers and sellers have continued to transact, but with greater discipline and sharper underwriting. Read our Northern Virginia Commercial Real Estate report below to learn more.

At Serafin Real Estate, we’ve been at the forefront of many of these deals, including our $12.5 million sale of 21205 Ridgetop Circle in Loudoun County in Q2 2025. But beyond individual successes, the big picture matters. Below is a breakdown of the numbers—and what they mean for owners, investors, and commercial real estate professionals focused on this region.

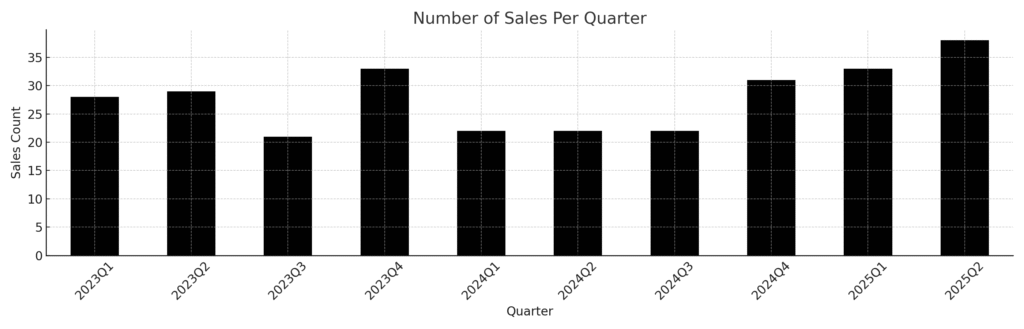

Loudoun County: Strong Demand, Stable Pricing

- Total Sales (Q1 2023 – Q2 2025): 281

- Average Price Per SF: $430

- Average Cap Rate: 6.44%

Loudoun’s commercial real market has stayed steady, with activity spread across flex, retail, and industrial. Flex properties continue to command premium pricing thanks to their versatility and modern layouts. Retail—especially NNN-leased—also drew significant investor interest. Older office buildings saw some pricing pressure, but leased modern product remained competitive.

The cap rate average of 6.44% reflects a market where stabilized assets are still in demand. While data center zoning restrictions in Loudoun may slow one segment of development, they’re opening the door for education, healthcare, and mixed-use growth in previously off-limits areas.

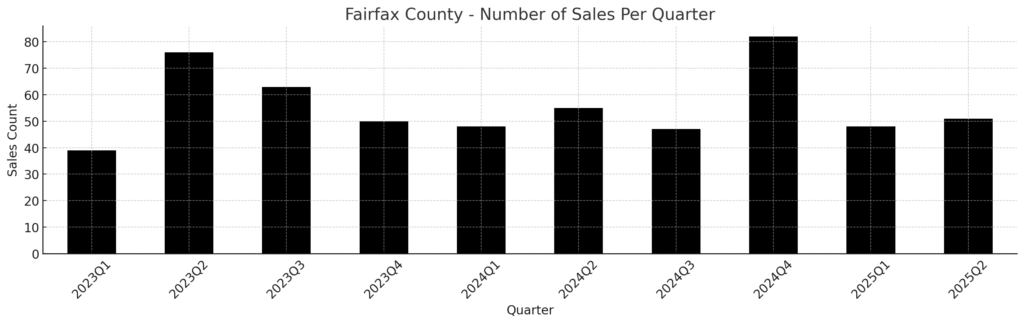

Fairfax County: The Core Market with Consistency

- Total Sales: 559

- Average Price Per SF: $430

- Average Cap Rate: 6.41%

Fairfax County led the region in total transactions. Flex and retail assets—especially those near transit hubs like Tysons, Reston, and Springfield—were the top performers. High-income demographics and a strong jobs base in government contracting and healthcare continue to fuel service-related demand.

After a slow start in 2023 due to rate hikes, deal volume increased in late 2024 and early 2025 as rates stabilized and underwriting aligned. Fairfax is proving that consistent fundamentals will always win in the long run.

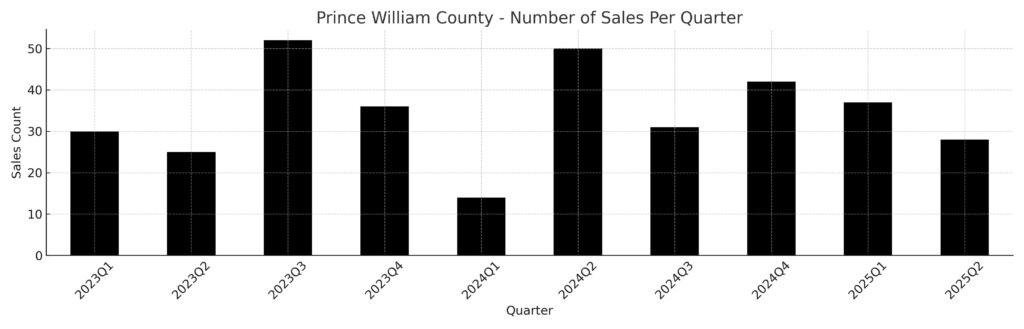

Prince William County: The Smart Capital’s Value Play

- Total Sales: 345

- Average Price Per SF: $352

- Average Cap Rate: 7.01%

Prince William may lag in volume, but it’s gaining fast. Buyers priced out of Loudoun and Fairfax are turning to PWC for higher yield opportunities. Flex and industrial buildings in Manassas, Gainesville, and Woodbridge are seeing the most traction, especially among owner-users and local developers.

With the highest cap rates in the region and some of the lowest price points, Prince William is positioning itself as the value-oriented option for long-term investors willing to get ahead of the curve.

What This Means for CRE Owners and Investors

The common thread across all three counties? Commercial real estate is still moving—just more selectively. Buyers want well-located, leased, stable assets. Sellers who are realistic and prepared are still achieving strong results.

Whether you’re looking to sell a flex building, offload a stabilized retail center, or time the market with a 1031 exchange, you need a brokerage that understands what’s closing and why.

At Serafin Real Estate, we’ve led dozens of these transactions over the past 24 months. We know the buyers. We understand the underwriting. And we bring deals across the finish line.

Ready to Talk Strategy?

If you own a commercial property in Loudoun, Fairfax, or Prince William, let’s talk. Visit serafinre.com or email us at brokers@serafinre.com for a confidential valuation.