Analyzing Loudoun County’s Commercial Real Estate Trends: The Interplay of Economic Indicators and Local Developments

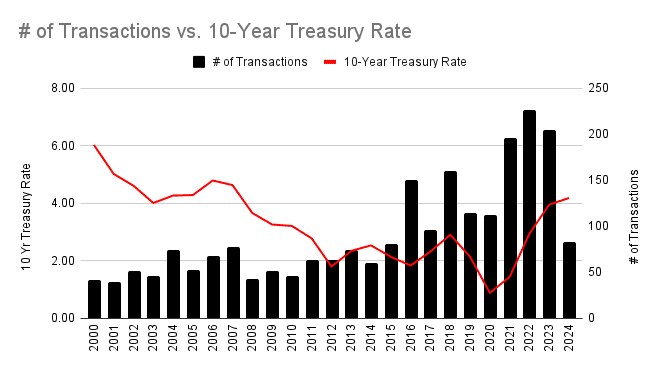

Loudoun County’s commercial real estate market has experienced significant growth over the past two decades, influenced by national economic trends, local policy decisions, and sector-specific developments. By examining historical data on interest rates, transaction volumes, sales totals, and average sales prices, alongside key local events, we can gain insights into the factors shaping this dynamic market. Excluding commercial condos, there are currently 3,013 commercial properties in Loudoun County. As of the end of Q2 2024, the county stood at a total of 83 sale transactions, a lower pace than 2023 that saw 205 total sale transactions, and 2022 in which 226 sales transactions occurred.

[ez-toc]

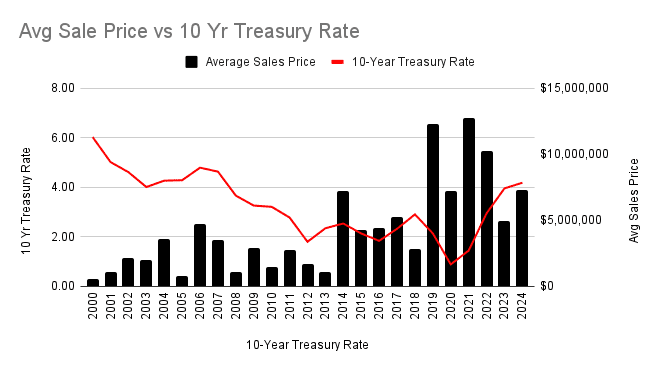

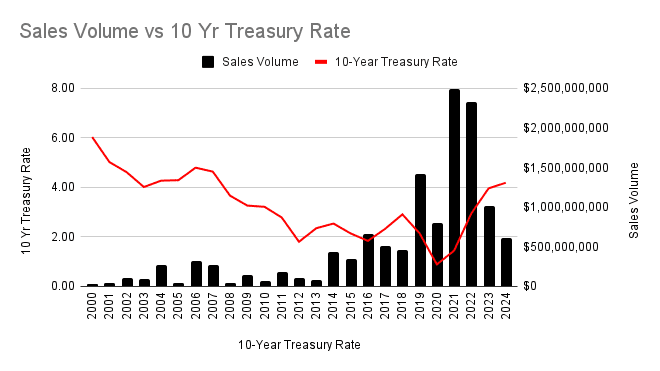

Let’s take a look at the historical data, and compare interest rates vs the number of transactions, sales volume and the average sales price.

Historical Data Analysis (2000-2024)

Interest Rates and Transaction Volumes:

- 2000: The 10-Year Treasury Rate began at 6.47% in Q1 and decreased to 5.57% by Q4. During this period, the number of transactions increased from 11 to 16, suggesting that lower interest rates may have facilitated more deals.

- 2008-2009 (Great Recession): Interest rates were reduced to stimulate the economy, yet transaction numbers remained low, reflecting broader market hesitancy.

- 2020-2021 (COVID-19 Pandemic): Interest rates were again lowered to support economic activity. Despite the pandemic’s challenges, Loudoun County’s commercial real estate market demonstrated resilience, with transaction volumes rebounding quickly.

Sales Volume and Average Sales Price:

- 2000: In Q4, with an interest rate of 5.57%, sales volume surged to $14 million, driven by an increase in transactions. The average sales price also rose to approximately $880,587, indicating larger transactions closing in a stable rate environment.

- 2008-2009: Both sales volume and average sales price declined sharply due to economic uncertainty and tighter credit conditions.

- 2020-2021: While some sectors faced challenges, the data center industry in Loudoun County thrived, contributing to stable or even increased sales volumes and average transaction sizes. Industrial assets, due to the need for warehousing and distribution, also surged during this time. Loudoun’s current vacancy rate on Flex Industrial is only 0.6%. Demand remains high, and inventory is very low, continuing to push pricing.

Impact of Population Growth and Local Developments

Loudoun County has experienced significant population growth, adding an average of 30 new residents each day, leading to a 29% population increase since 2010. This surge has bolstered demand for commercial properties, particularly in sectors like early education and industrial real estate.

Key Developments:

- Data Center Expansion: Known as “Data Center Alley,” Loudoun County has seen substantial growth in data center developments. This expansion has driven up demand for commercial properties, increasing sales volumes and average transaction sizes.

- Transportation Infrastructure Improvements: Enhancements to major routes like Virginia State Route 28 and Route 7 have improved accessibility, making Loudoun County more attractive for businesses. These improvements have positively influenced commercial real estate transactions and values.

- Zoning and Land Use Policies: Changes in zoning regulations to accommodate mixed-use developments and commercial projects have facilitated growth in the commercial real estate sector. Such policy adjustments have led to increased transaction numbers and sales volumes.

- Opening of the Ashburn Metro Station: The inauguration of the Ashburn Metro Station has enhanced connectivity, making the area more accessible and attractive for commercial investments.

Correlation Analysis

Comparing local data with national economic benchmarks reveals correlations:

- Interest Rates vs. Transactions: Lower interest rates often align with increased transaction numbers, as borrowing becomes more affordable.

- Inflation’s Impact: Elevated inflation can lead to higher interest rates, affecting borrowing costs and, consequently, real estate transactions.

- GDP Growth: Strong GDP growth often correlates with increased business activity, potentially boosting commercial real estate transactions and values.

Conclusion

Loudoun County’s commercial real estate market is shaped by a confluence of national economic trends, local policies, and sector-specific developments. Understanding these factors is crucial for making informed investment decisions in this dynamic market.

For expert guidance on navigating Loudoun County’s commercial real estate opportunities, contact Serafin Real Estate today.