Loudoun County Commercial Real Estate

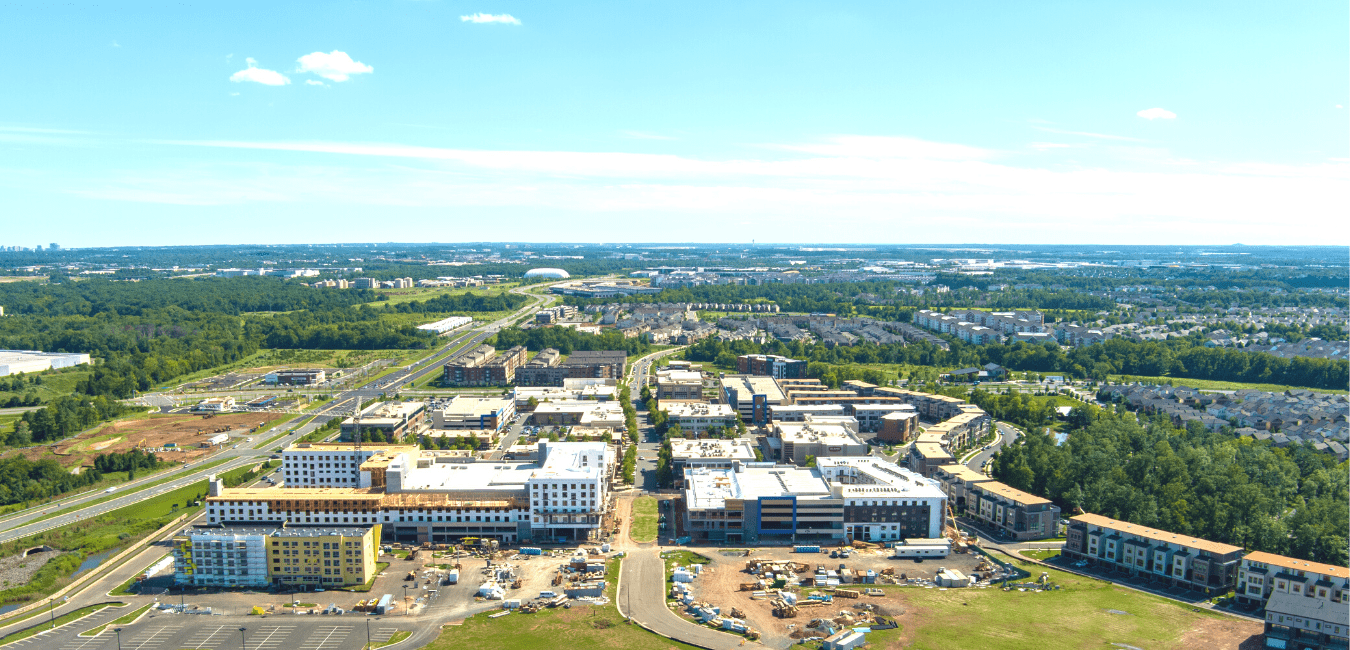

Loudoun’s commercial real estate market for the 3rd Quarter of 2021 is strong. Before we look at the detailed numbers, let us provide some context. CNBC’s annual “America’s Top States for Business” ranks Virginia as #1. Loudoun County, so far, in 2021 has seen 145 new businesses (open or expand, either by hiring more people or acquiring more floor space.) In the first three quarters, Loudoun saw more than $6.5 trillion in new commercial investment and more than 3.7 million square feet of new commercial space. SmartAsset ranks Loudoun as Virginia’s 10th strongest county for economic development with a business growth rate of 8.4%, partly because of its geographic location and partly because of its Fast Track Commercial Incentive Programs.

We will now look more closely at Loudoun County’s Q3 numbers for office spaces.

Loudoun County CRE Sales for Q3

Q3 2021, saw an overall total sales volume of $563,031,632 at an average $/SF of $249. This compares well with 2020’s Q3 sales of $378,738,186 and a $/SF of $236. There were 89 properties still listed for sale at the end of Q3. The total square footage for sale in the quarter totaled 312,500 SF. The average asking price per square foot was $275 in July, rose to $280/SF, and ended the quarter with an average asking price of $273/SF.

The market sales price varied across a wide range. Taking the total sales volume and breaking it down into $/SF groupings, we see the following:

- Approximately 5% of sales had a $/SF of below $180.

- 15% were between $180 and $210.

- 32% were between $210 and $240.

- 15% were between $240 and $270.

- 13% were between$270 and $300.\

- 10% were between $300 and $330.

- 10% were above $330.

With a different perspective, we see that most:

- Individual sales ranged from $100 to $200/SF.

- Portfolio sales ranged from $310 to $390/SF.

- Condo sales ranged from $205 to $245/SF.

Cap Rates

The overall market cap rate for Q3 in Loudoun, across all property types, was 7.5%. It is fairly stable and is forecast to remain so. Approximately 72% of all transactions had cap rates of between 7% and 8%. The lowest was 4-5%, and the highest was above 11%.

Individual property sales saw an average cap rate of 7.5% at the beginning of the quarter, rising slightly to 7.6% at the end of September. Condo sales averaged 7.1%, dipping slightly during the quarter, but still ending September at 7%.

If we look at cap rates by star rating, we see:

- Cap rate for 1-2 Star properties averaged at just below 7.5%.

- Cap rate for 3 Star properties was fractionally below 7.6%.

- Cap rate for 4-5 Star properties was just above 7.2%.

Seller and Buyer Profiles

As a percentage of sales volume, seller types were as follows:

- Institutional 42%

- Private 33%

- Private Equity 15%.

- Owner-Use 8%

- REIT/Public 2%

55% of sellers were locally based, 44% were national names, and 2% were based outside the USA.

Buyer types were:

- Institutional 48%

- Private 34%

- REIT/Public 11%

- Owner-User 7%

79% of buyers were national names, 19% were locally based, and 2% were buyers based outside the USA.

A Brief Summary of Lease Data

Net absorption in Q3 stood at the highest level for 2021. Net absorption for the past 12 months calculates out at 183,000 SF. Occupancy rates stand at 90.1% and are forecast to rise a little in Q4 and then level off during 2022. The average market rent per SF currently stands at $28.00/SF, while the vacancy rate is continuing its 2021 drop, ending the quarter at 10%.

Final Comment

Loudoun County’s economic record and current commercial real estate statistics speak for themselves. Owner-users, major corporations looking to expand into a growth area, and buyer-investors looking for predictive results and potentially rising cap rates, should consider anywhere in Northern Virginia, and focus on Loudoun.

Serafin Real Estate has a current listing inventory offering a range of opportunities. You may be looking for a NNN business investment, space to meet your company’s expansion plans, or an educational establishment such as a pre-K or Montessori school.

Our expertise ensures our clients receive comprehensive acquisition and investment representation. Strategic forward planning, total and transparent investment analysis, and financial structuring, targeted at specific goals, are the tools of our trade. When working with owners, we employ the latest technology to market properties locally, nationally, and internationally to specific target markets and qualified buyers.

To arrange an initial consultation, or to ask us any questions about opportunities in Loudoun, Fairfax, or Prince William Counties, please use this form. If you prefer, call us directly at (703) 261 4809.